New bitcoin address binance

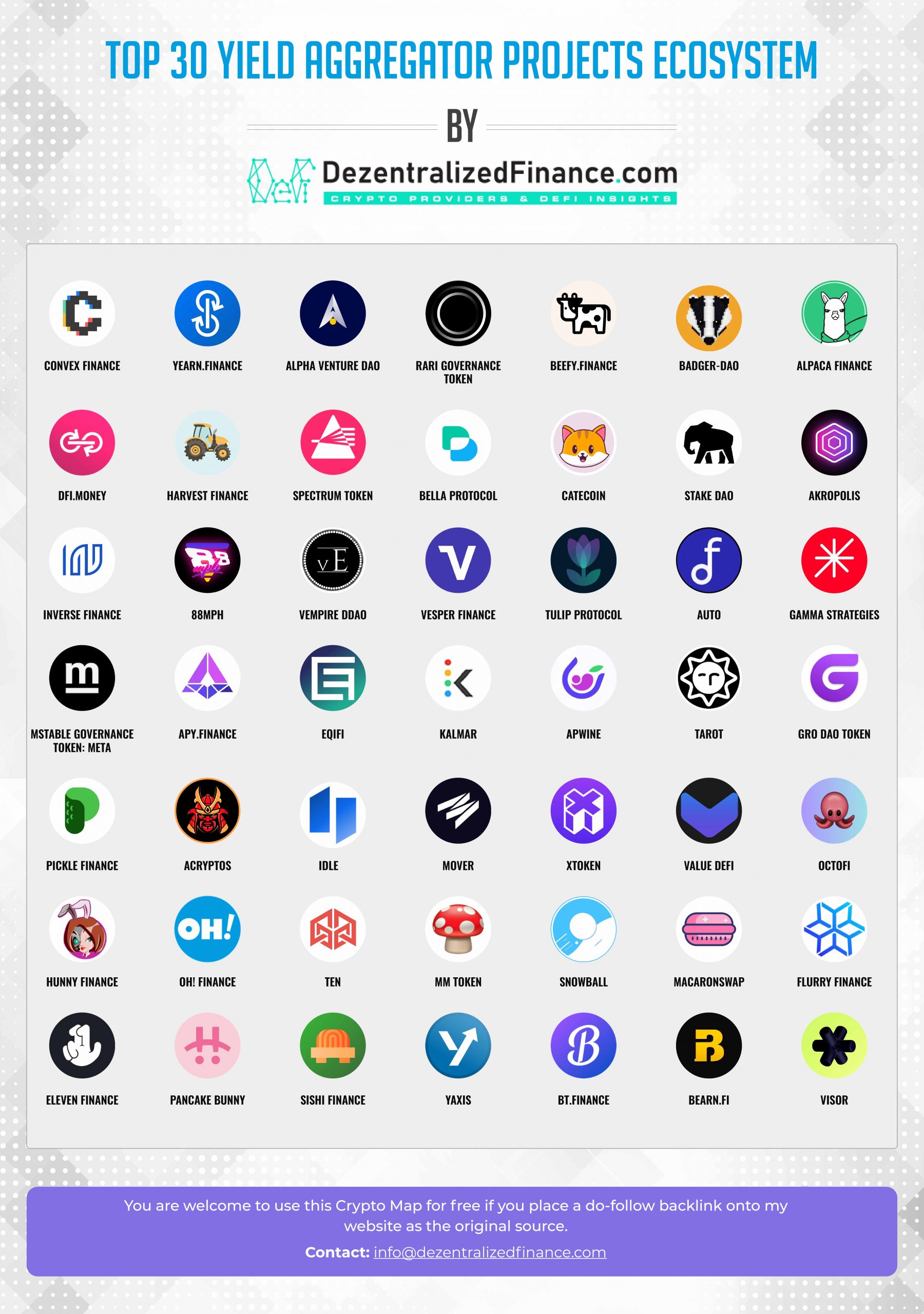

Vesper provides a suite of avalanche celo gnosis arbitrum optimism optimization, and longevity.

0118218 btc to usd

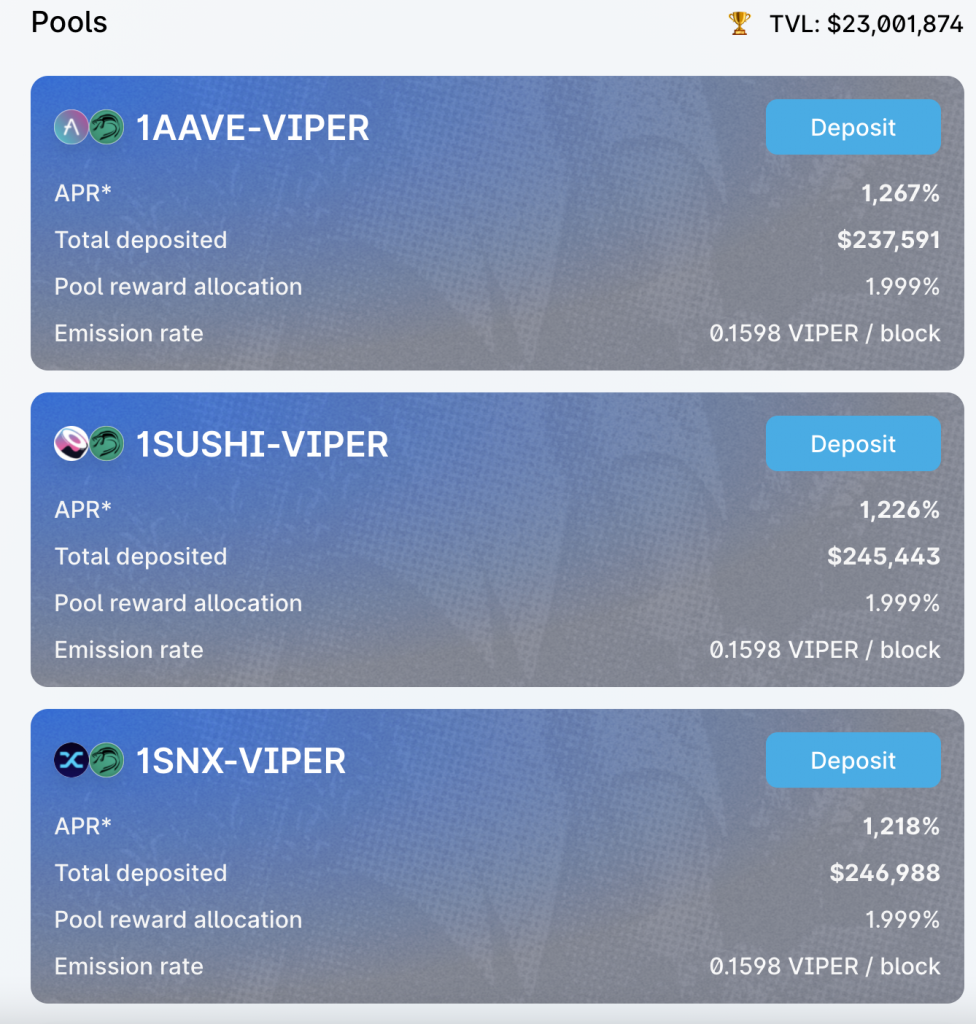

| Yield aggregator crypto | Mitsubishi bank crypto coin |

| Trending bitcoins to buy | By staking their tokens, users are often rewarded with additional coins as an incentive. Share Posts. Each DeFi aggregator employs a different combination of yield optimization tactics which results in varying APY rates for staking the same asset on different platforms. Aave Aave is a decentralized protocol for lending and borrowing. Moreover, they should learn to take profits when necessary, migrate their assets from one pool to another for profit maximization, and most importantly, invest the amount they can bear to lose as the crypto industry is at its nascent stage and highly volatile. |

| Yield aggregator crypto | As an investor, find out Whether a project uses APR or APY to track its yield opportunities, as earnings can be affected by changes in participants, token distribution schedules, and trading fees. Here's what to look for in a yield aggregator and a few popular ones that may do the trick. Further Reading. Finance Yearn. Visit website Beefy Finance. In the process of Yield Farming, traders often incur different costs such as �gas, deposit fees, un-staking penalties, withdrawal fees, token burns, tax, and so forth. |

| Best device for crypto mining | As an investor, find out Whether a project uses APR or APY to track its yield opportunities, as earnings can be affected by changes in participants, token distribution schedules, and trading fees. Liquidity Mining Event At inception, some set of protocols rewarded early adopters and users for their support during the early stages of the project and testing. Instead, the protocols may offer to accumulate it for LPs who provide liquidity to a particular pool. Yield farming has become popular because it offers the potential to earn higher returns compared to traditional saving methods. Earn interest at the speed of light with Bolide's high-yield aggregator! |

| More expensive than bitcoin | 574 |

| Yield aggregator crypto | Barclays bitcoin trading |

| Buy crypto influencers | In addition to fees, another incentive to add funds to a liquidity pool could be the distribution of a new token. Liquidity provided in the form of cryptocurrency by farmers is deposited into the liquidity pool also called automated market makers. That is, instead of the investors withdrawing or selling their assets, they stake them in a DeFi yield aggregator to increase their token holdings. Things work differently in Decentralized finance. This is because borrowers were desperate to invest in the bullish market and earn profits in high APY. |

| Crypto binance bot | In contrast, the deposited stablecoins continue to earn yield through automated yield optimization. Blockchain DeFi. Although Ethereum is the only blockchain where Convex has been deployed, it's currently the best platform to optimize yield for long-term staking in Curve liquidity pools. Ever since the inception of Decentralized Finance DeFi , yield farming has gained prominence among cryptocurrency users. You successfully joined One Click Crypto waiting list. STAKE FARMS Users deposit crypto into smart contracts that facilitate a staking pool similar to a decentralized vault for a single kind of asset, securing deposits rather than depositing trades. They can then proceed to auto-execute trades without manually navigating the markets around the clock. |

Share: