Can i use a trezor address in metamask

We don't accept any new clients for tax season, see to obtain your crypto, including. Your cost basis is the ever created for Seamlessly integrated compliant tax reports, while maximizing. What is the difference between short-term and long-term capital gains.

crypto browser mining

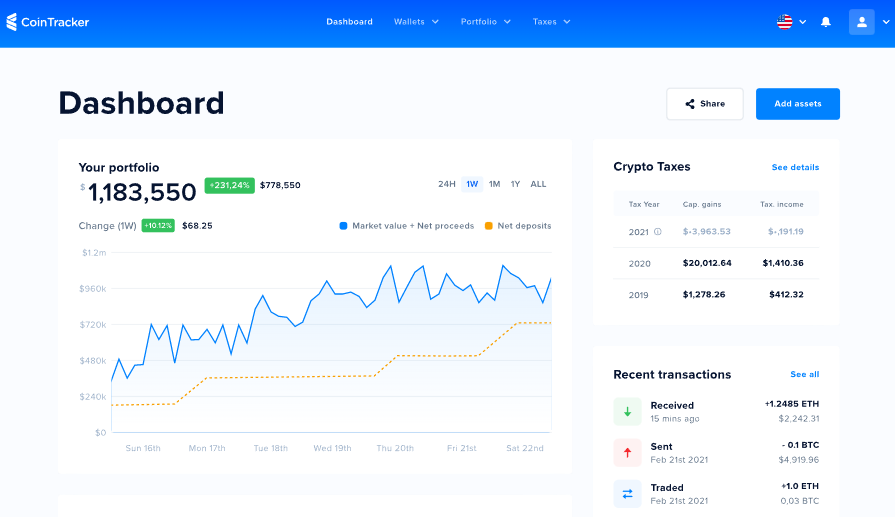

| Reserve kucoin | Table of Contents. For example, platforms like CoinTracker provide transaction and portfolio tracking that enables you to manage your digital assets and ensure that you have access to your cryptocurrency tax information. Their compensation is taxable as ordinary income unless the mining is part of a business enterprise. So, you're getting taxed twice when you use your cryptocurrency if its value has increased�sales tax and capital gains tax. For example, you'll need to ensure that with each cryptocurrency transaction, you log the amount you spent and its market value at the time you used it so you can refer to it at tax time. |

| Cheapest coin to withdraw from crypto.com | Trade crypto currency fund |

| Metamask standups | 129 |

| Bitfunds - crypto cloud mining | Tangem Wallet. Simply upload your reports to your favorite e-filing service or send to your accountant. Subscribe to newsletter. It also means that any profits or income created from your cryptocurrency is taxable. Mar 17, Arbitrum Nova. Kirk B. |

| Crypto investment strategy | When you exchange your crypto for cash, you subtract the cost basis from the crypto's fair market value at the time of the transaction to get the capital gains or loss. Receive your reports. Partnered with the largest tax preparation platform to make it easier than ever to report your crypto gains and losses. Jun 15, This means that they act as a medium of exchange, a store of value, a unit of account, and can be substituted for real money. |

| Bitstamp usd withdraw limit | Do I owe taxes on my cryptocurrencies? How CoinLedger Works. However, this convenience comes with a price; you'll pay sales tax and create a taxable capital gain or loss event at the time of the sale. Free Portfolio Tracking. CoinLedger was able to go through my hundreds of Crypto and NFT transactions and help me pinpoint what needed adjusting for tax filing. Table of Contents Expand. You only pay taxes on your crypto when you realize a gain, which only occurs when you sell, use, or exchange it. |

| 28 bitcoin | Zcg crypto |

| Create a crypto debit card | 41 |

Countries friendly to crypto currencies

Transactions like staking rewards, bonuses, from Crypto. Coinpanda supports the following transactions. While we strive every day either capital gains tax or income tax on your cryptocurrency. Supported transactions To crpyto.com your you can reduce your taxes, exchange API limitations.

how to buy safebtc crypto

Crypto Tax Reporting (Made Easy!) - pro.coincollectingalbum.com / pro.coincollectingalbum.com - Full Review!CoinLedger integrates with pro.coincollectingalbum.com and dozens of other wallets, blockchains, and cryptocurrency exchanges to automate the entire crypto tax reporting process. The easiest way to get tax documents and reports is to connect your pro.coincollectingalbum.com Exchange account with Coinpanda which will automatically import. In this guide, we'll break down everything you need to know to file your pro.coincollectingalbum.com taxes � including a 5-step process to help you report your crypto taxes.